Market Reality Check

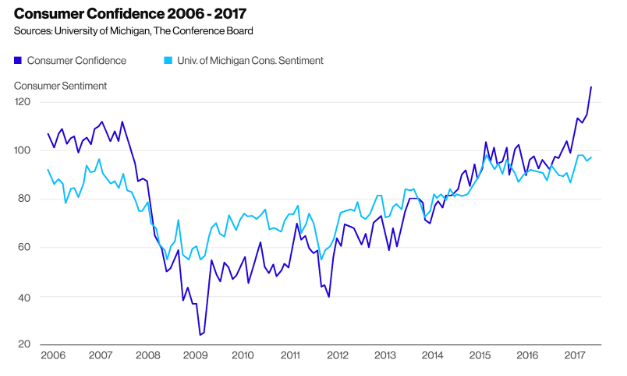

We witnessed a remarkable change in sentiment after November of 2016. Optimism surged among investors, business owners, and consumers alike, as I began highlighting in my year-end outlook. National consumer sentiment measures jumped, and by May 2017, they remained near their highest in 15 years. The NFIB’s Small Business Optimism index is the most vivid example of the surge in business confidence—it jumped by a record 11 points in November 2016 and continued to rise to a 12-year high. Finally, rising investor confidence manifested itself in a strong stock market rally after the US presidential election:

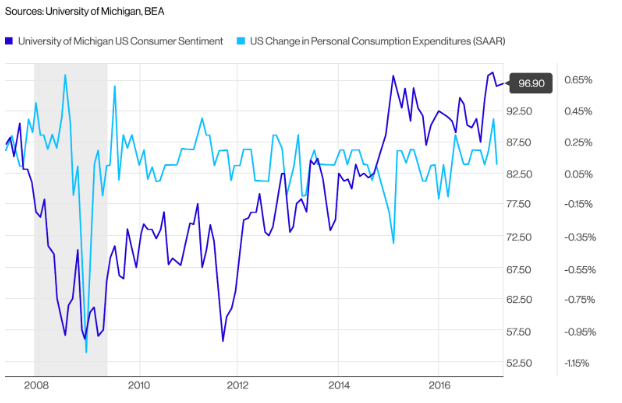

Consumer confidence is typically a leading indicator, and it’s usually followed by corresponding changes in consumption. But despite the surge in confidence, consumer spending did not experience sustained growth in the months after the election. While manufacturing and durable goods improved, consumption—which makes up 70% of the US economy—did not see significant improvement in the beginning months of 2017. After a strong 0.4% January growth, spending rose by a lower-than-expected 0.1% in February:

The S&P 500 index rallied nearly 13% in the months following the presidential election, on top of its already-high valuation. Its price-to-earnings ratio and price-to-book ratio were at the highest levels in 15 years in the spring of 2017. This implies that the market had priced-in high growth expectations, although subsequent Q1 GDP reporting may have given a dose of cool reality to excited investors.

Economic Growth

Pro-growth policies and the goal of at least 3% economic growth put a high importance on the first GDP report of President Trump’s administration. But the BEA’s initial estimate of Q1 GDP growth was reported at 0.7% annualized, which was consistent with an earlier estimate by Atlanta Fed’s GDP-Now model of 0.5%. This was well below 2016’s 2% growth, which itself was a disappointing continuation of the low-growth environment that had been in place since 2010. Granted, GDP is a lagging report, and it seems to be dismissed by the market as a “rear view”—the market tends to be forward-looking.

In addition to economic numbers, I think that investors might have face a reality check in several other areas in the days and weeks following that spring.

Inflation and European Central Banks

Consistent with strong employment numbers and with US inflation rebounding to 2%, the Fed had continued to normalize interest rates by raising rates twice between December 2016 and April 2017, and longer-term rates rose above inflation.

Not so in Europe.

In the eurozone, the welcome rebound in inflation to 1% (and to 2% in the UK) was not quickly followed by central bank action, with most European government yields remaining near zero. The situation of interest rates sitting below inflation benefited highly indebted governments, but had negative longer-term economic consequences. The ECB had few good options available, in my view, and needed to be very careful to adjust policy to “normal, but not too normal.”

Global Geopolitical Risks

Shows of force revolving around North Korea dominated the news in spring 2017, but I think that the Middle East had the potential to become a more serious problem due to Russia’s involvement. The victory of Emmanuel Macron in France’s presidential election relieved some fears related to European populism and the dissolution of the EU, but popular political pressures remained. In addition, Greece’s economic numbers and debt payments made me think that Europe could increasingly dominate financial news—possibly interrupted by events in Latin America, where Venezuela was failing as a state and Brazil’s economic troubles persisted.

About the Author

Roman Chuyan, CFA, is the president of Model Capital Management LLC, a Boston-based investment manager focused on asset allocation. Roman founded the firm in 2012 to provide tactical and strategic asset allocation portfolios to help advisors outperform a passive index. The firm’s strategy is powered by a fundamental-factor forecasting approach that Roman developed over the previous decade.

In prior years, Roman held positions with buy-side firms JH Investments (2008-2010), CypressTree (2006-2008), and John Hancock Life Insurance Company (1998-2006). He focused on asset allocation, fixed income, credit markets, and derivatives and developed risk management and valuation models.

Roman holds a master’s degree in finance from Bentley University in Waltham, Massachusetts.