Market Risk in 2017: The FRTB Challenge

“Risk management is asking what might happen the other 1 percent of the time” —Richard Felix, chief credit officer at Morgan Stanley

In 2007, Warren Buffett offered an open bet to anyone brave enough to challenge him. He put $500,000 on the line...and only one person took him up. The bet? That no “fund of hedge funds” selection could outperform a simple S&P 500 index tracker over a 10-year period. We are now nine years into the bet, and Mr. Buffett is way ahead.

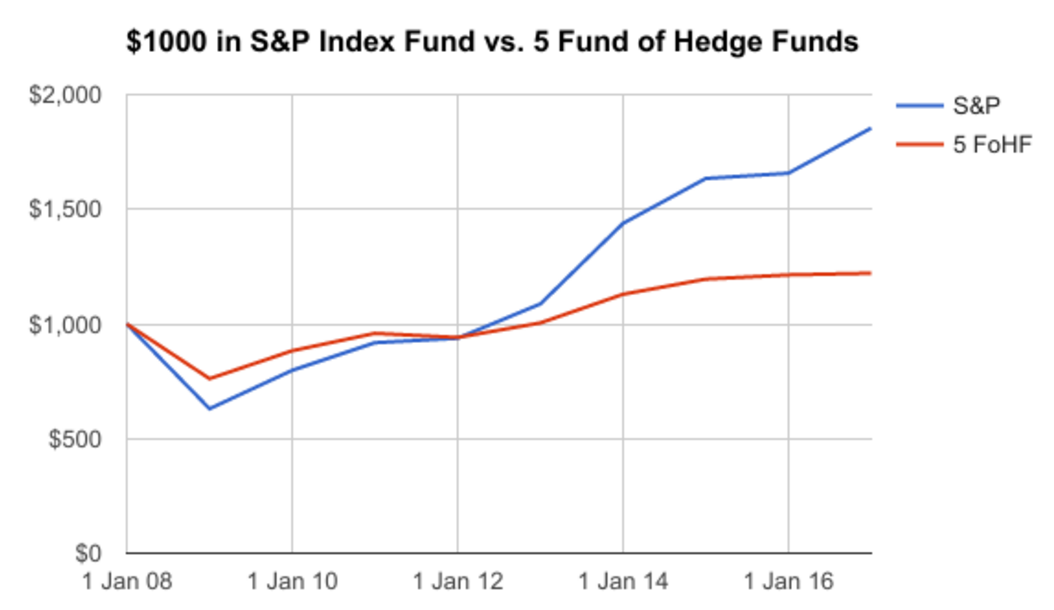

Figure 1. Performance comparison of the two strategies over last nine years.

The bet, however, focused on absolute return, net of all fees. Risk is not considered in the equation. Volatility of annual return (a measure of risk) to date is 20% for the index fund vs. 12% for the portfolio of hedge funds. Today, risk management is a key theme on the agendas of all major financial institutions.

Market risk is the risk of losing value of financial instruments from changes in market prices.

A Brief History of Market Risk

Over the last 30 years, banks have ramped up their market risk functions, building out teams looking at areas such as value-at-risk, economic capital, backtesting, and stress testing.

And since the 2008 crisis, regulatory demands in particular have ramped up. One of the main regulations looming is the Fundamental Review of the Trading Book (FRTB), the Basel Committee on Banking Supervision's attempt to enhance modeling standards. Amongst risk professionals, this is commonly referred to as the biggest overhaul of market risk models in the last 20 years. The aim is to contribute to a more resilient banking sector, using new standards to reduce the variability of capital requirements across jurisdictions by building on lessons learned.

Regulation has led to two types of capital models: standardized (prescribed) and internal models. Banks with an internal model currently calculate capital requirements based on VaR / Stress VaR, plus a default and migration risk model. One day out of a hundred, you expect to lose more than VaR. Thus, VaR is a forward-looking risk measure.

As the positions in a trading book change every day, simulation models are used. These can vary greatly across institution, both in composition and sophistication. The scenario generation can use Monte Carlo or historical simulation. P&L estimation uses full revaluation, or sensitivity-based approaches (“greeks”). Most firms would use a mixture of these approaches across their portfolio.

So What’s Changed?

The main changes from the current “Basel 2.5” standards to FRTB are:

Stricter trading/banking book boundary. Detailed instructions on which products can be held in the trading book, to prevent regulatory arbitrage.

Desk-level internal model approval. Every trading desk would have to individually pass strict tests on P&L attribution and backtesting, or fall back to the standardized approach. Securitizations are no longer allowed to be modeled. Backtesting compares the predicted losses from VaR with realised P&L. In addition to backtesting against hypothetical P&L (if no trading took place), the tests are expanded to backtest against actual P&L. The attribution tests evaluate the differences between the risk and front office pricing models.

Move from VaR to Expected Shortfall (ES). ES considers the expected loss in the tail of the distribution and addresses many of the longstanding theoretical deficiencies of VaR.

Actual 10-day returns. Actual returns are used instead of scaled 1-day returns. Since financial returns are known to be non-normally distributed, modeling 10-day moves instead of using the model of 1 day times square-root of 10 should be more accurate.

Varying liquidity horizons. Ranging from 10 to 120 days, these scale up the ES to recognize the illiquidity of different risks.

Reduced diversification recognition. Only half of the impact of empirical correlations between asset classes is considered.

Non-modelable risk factors. All risk factors require sufficient observability to be included in the ES model, or else they are to be capitalized individually with a punitive NMRF charge. Effectively, it’s an assessment of how frequently the opportunity to trade a particular instrument arises.

Revised standardized approach. The new sensitivity-based approach takes some greeks (“delta” and “vega”), and nonlinear risks (“curvature”) and prescribes an aggregation approach with specified risk weights, correlation, and no asset class diversification. Residual risks are captured with a notional based add-on. Every bank has to compute a firm-wide standardized charge, which could serve as a floor to capital requirements.

Impact on Banks

The timeline for compliance is 2019–20. The effort is recognized to be significant, particularly in terms of implementation, market data, and passing the model eligibility tests. Major IT investment is needed to align the risk and front office models. In practice, collaboration between risk and finance is also essential. Regular impact assessments are ongoing; the latest indications are of a significant required increase in capital (thought to be +50–150%.)

Naturally, some areas are affected more than others and the viability of some trading businesses is likely to come under threat.

Although the regulations are global, enforcing them is the responsibility of national regulators. Whilst European regulatory bodies are pushing ahead, it is not yet fully apparent what timeframes the US is looking at, or how US entities of multinational firms will be impacted.

Impact on the Industry

Clearly, the bottom line will be affected by higher capital. In addition to shareholders, the costs could pass through to clients (by including capital valuation adjustments in prices). Traders may request a capital impact before placing a trade—the costs may affect their choice strategy. Herding of trades toward the liquid names could result in the illiquids becoming even less liquid. Generally, exotic products are more impacted than vanillas.

While compliance will initially be the primary goal, over time, pressures to increase return on equity could lead to innovative new trading strategies. On a human level, firms will aim to become leaner and more efficient.

Financial services companies are embracing the opportunities. Implementation, advisory, and data vendors (of observability data) are in demand. Although the rules have been “final” since January 2016, lobbyists are still attempting to influence the shape of regulations. The P&L attribution and the stringent treatment of basis risk under the standardized approach are two of the key areas of pushback.

Looking Forward

It's a common saying amongst academics, that all models fail. Endogenous risk, rising correlations, and flight to quality are notoriously difficult to model for. The BCBS has aimed to account for these through the enhanced framework. Only time will tell if they have gone far enough.

Do You Practice What You Preach?

Returning to the initial discussion of the bet, the hypothetical S&P 500 index fund would be valued at $1,854 and the fund of hedge funds portfolio at $1,221. If the $1,000 seed money was instead put in Berkshire Hathaway stock, the value would be $1,722 (with a volatility of 21%), telling us that even Warren Buffett himself wouldn’t have outperformed his own benchmark over this period.

About the Author

Suraj Amlani is a quantitative analyst working in London. He has worked with European banks on derivative pricing, market risk models, and analyzing the impact of FRTB. Connect with him on LinkedIn at: https://www.linkedin.com/in/suraj-amlani-cfa-b030ab2a/